Is a guaranteed return investment plan the best option available in the market right now?

Table of Contents

All insurance schemes of all types of money back, pension, and guaranteed returns work on more or less the same principle. The return is also from 5% to 7%, usually around 6.25%. If you analyze the return perspective of these types of assured returns investment plans then the question arises are “Guaranteed or assured return plans really good options for Investment“.

Guaranteed or assured returns investment plans may not be the perfect option for you if you put a little bit of effort before making any investment decision because it is not the best option available in the market right now.

My motive is not to demotivate you from investing in all these plans but to encourage you to invest, the only difference is your investment decision should be an informed decision. Think logically, I am trying to encourage you to grab the best outcome for your investment that you are already invested in or plan to invest that’s why you are spending your time reading this blog. It is your money, and your time then why you have not deserved more when there is a possibility, the only thing is you need a little bit more information and research work on your part.

You will be much better with:

a) if you purchase a Term Insurance plan of one Crore or more. Also, the premium will be much cheaper.

b) Invest the remaining portion of the premium in the Mutual fund and get much better returns or invest in PPF but there is an upper limit cap on this.

I know when it comes to investing in a mutual fund there is a lot of questions arise about certain things like investment safety and security, how much return it will give, is there any better option to invest. We will cover all these prospects in detail in here in this blog post.

Why do you need insurance policies of a “Guaranteed or assured returns investment plan”

Unfortunately, people ask this question after they have already enrolled in the insurance policy. Unfortunately, people fall for the phrase “guaranteed and assured returns investment”. People also look at the assured return amount and never think that how inflation is going to affect the amount. You are not alone.

I too have fallen prey to these insurance policies. Eighteen years ago, I signed up for a LIC Jeevan Anand policy with a coverage of 5 lakhs and a premium of 22,336. After 25 years, I would get 5 lakhs. In 2003, 5 lakhs sounded like a very tidy amount to me. What does it sound like today?

Today, I am paying more than this amount in Income tax alone. The CAGR is a paltry 6.73%! Like many others, who are not financially aware, I realized this pretty late – just a year ago. Now that the policy is maturing in 2028, I now think that it is better to continue. This is exactly what happens.

Lesson 1: All assured returns investment plans have a poor return on investment ranging from 5.25% to 6.98%.

An Example of a Guaranteed return insurance plan review

Today we will dig into the HDFC Standard Life Sanchay Plus scheme. Here are the broad highlights of the plan that I was shown (there are many variations):

Policy Name: HDFC Life Sanchay Plus

Policy Term: 6 years

Premium Paying Term: 5 years

Premium: ₹6,00,00 + GST (4.5% in first year, 2.25% in next four years)

Sum assured: ₹62,10,000

Guaranteed Pay-out: ₹1,99,500

Guaranteed Pay-out period: 30 years

Terminal Benefit: ₹31,99,500

What does this jargon mean? This means I will pay 6,27,000 in the first year, and 6,13,500 in the next four years, 6 years is a cool-off period for me (I don’t need to pay, I don’t get anything). From year 7 onwards I get 1,99,500 as guaranteed income per year for the next 29 years. In year 37, I get 31,99,500. If I happen to die anytime during the time the policy is the force (next 30 years), my survivor gets 62,10,000.

Does this insurance policy sound beautiful? I am sure that at the first reading it does:

- सिर्फ पाँच साल प्रीमियम भरना है (I have to pay a premium for 5 years only)

- 7 वे साल से अगले 29 साल, हर साल लगभग रु 2 लाख मिलेंगे (From year 7, I will get nearly ₹2 lakhs per year for next 29 years)

- 37 वे साल लगभग रु 32 लाख मिलेंगे (In year 37, I will get nearly ₹32 lakhs)

- बीमे की रकम है; कोई टैक्स नहीं लगेगा (All payouts are tax-free because this is insurance payout)

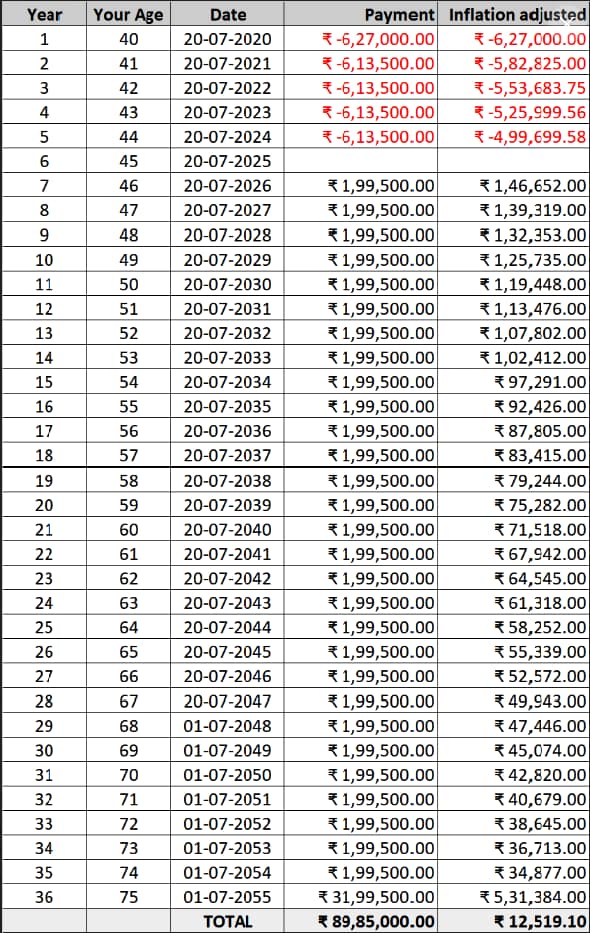

It is only when one digs deep, and performs the calculation of the return, then one can find out the real truth. Assume that you are 40 when you sign up. This is the chart:

HDFC-Life-Sanchay-Plus-Policy-Return-Calculation

Please compare real values vs. inflation-adjusted values. I have considered a 5% constant inflation for all the years. Does this bring out the stark-naked truth? Here are the astonishing facts!

- What do you think is the CAGR or actual return (4th column)? Return is a paltry 5.29%!

- Now hold your horses, take a deep breath, relax completely, and be prepared to be knocked off. What is the inflation-adjusted return? Inflation-adjusted return is 0.20%!!!

- You paid an inflation-adjusted ₹27,89,207.90 as a premium and you received an inflation-adjusted ₹ 28,01,727. The net payment you get is ₹ 12,519.10.

- This means that there is no extra return at all. You are barely getting your money back.

What if you put the same amount of money in Mutual Fund through the SIP

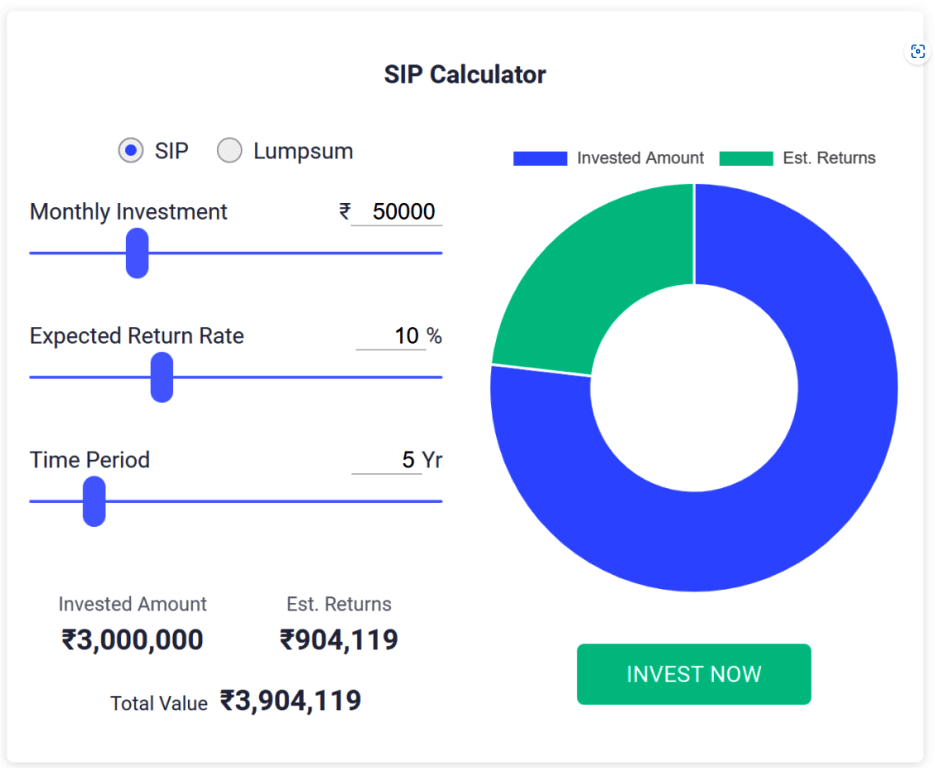

Let’s discuss, Consider that you saved ₹50,000 per month for 5 years in a Mutual Funds SIP. Then let the same money invest in the Mutual Fund for the next 31 years. I am going to assume a very-very conservative return of 10%. This is what it will be.

After 5 years, your SIP corpus will be ₹39,04,119 as shown below:

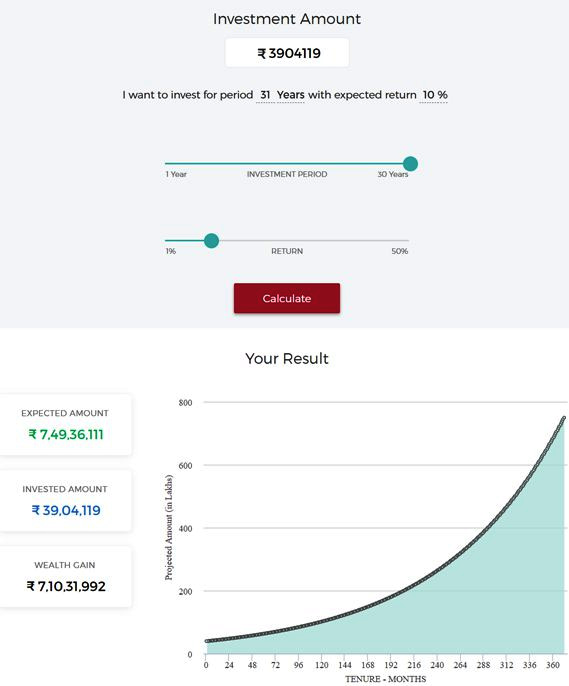

Now let it remain in the same Fund for the next 31 years. No more investment. In the end, at the same 10% average return, you will have a corpus of ₹7,49,36,111.

Even if you pay a flat 10% LTCG on this it will ₹7,49,3,611 and your balance at hand is ₹6,74,42,500. If we adjust this post-tax sum (₹6,74,42,500) for inflation at the same 5%, it is ₹1,12,01,079 at today’s value. Look at the difference, I would have ₹1.12+ Cr than some ₹28 lakhs.

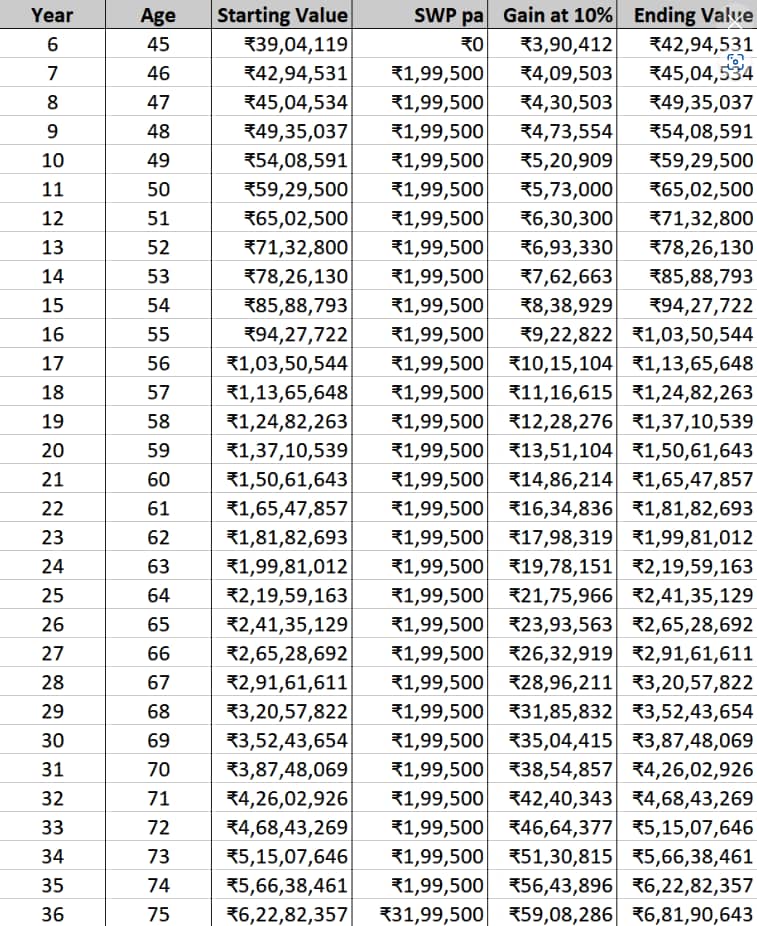

There is another option also if you go for the annual payout option, You could choose option Systematic withdrawal plan (SWP). For these calculations, I have taken into consideration of 10% yearly growth of the invested sum. But in some years you may not get that much of a return and you actually end up eating a little of your capital but that’s okay over the long run of 36 years It will adjust and more. If you go for this option then also the calculation looks like this.

I have even assumed that the payout is at the start of the year and hence not available for gain calculation, i.e., gain for the year = (begin value – payout) * 10%.

At the end of 36 years, one is still left with ₹6,81,90,643.

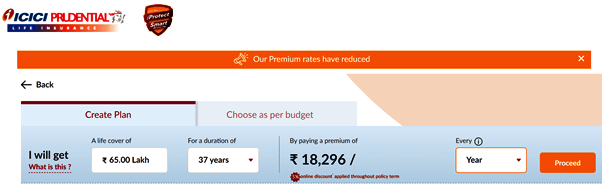

Now one may ask. What about the life insurance cover of ₹62,10,000? Does it not count at all? Does it have no value? So fine. Let us find out. I have considered a higher cover ₹65 lakhs pure term insurance from ICICI Prudential (don’t worry – all other insurers will have more or less the same premium).

Your age = 40 years

Premium cover = 37 years

Insured amount = ₹65 lakhs

Premium = ₹18,296 per year

Term insurance for 65 laks used in the calculation:

0 Comments