Remove disputes from credit report – really worth

Table of Contents

The only way to protect yourself and your money is to stay on top of Big Brother. There are laws about what can appear on your credit report, and disputing any mistakes or miss-reported items can double the rate your credit score rises, so you’ll achieve your financial goal much faster. Next, we going to discuss how to remove disputes from credit reports successfully with all the CRA’S.

“Dispute any mistakes or misreported items – can boost your score”

Of course, disputing items on your credit report can be a bit daunting. There are two ways to do it. The first option is to use various methods to remove the negative items from your credit report by yourself (Do it yourself way).

The second option is to take professional help (credit Repair Services) to remove disputes from your credit report. Obviously, they will charge you but they can do it faster.

How to remove disputes from credit reports – Steps

Before going to start disputing negative, it’s very important to take preparation for many other things. Here are all the things that you need to dispute a credit report. Find the whole process and the information step by step, just go through it.

Simple steps to follow when disputing negative:

- Collect a Free Copy of Your Credit Report

- Make an itemized list of everything showing on the report

- Contact Major agency’s dispute departments

- Simple Letter Format for Disputing Items on Your Credit Report

- Wait for 30 days to allow investigation but if necessary then follow up with the CRA’S in this waiting period.

- Simple steps to follow when starting disputing (Pro Tips)

- Frequently asked questions (FAQ)

Get a free copy of your credit report

Get your free credit report and most important you need an itemized list of everything showing on the report. Then understand and analyze every item on your credit report carefully and find the mistakes or misreported items on it.

All three agencies are required by federal law to provide you with a free annual credit report at your request once every 12 months. You also have 60 days to report a free copy if you’re denied credit, insurance, or employment based on bad credit. To order, visit annualcreditreport.com or call 1-877-322-8228.

Make an itemized list of everything showing on the reports

It’s not enough to just see your score. Also, before understanding how to dispute a credit report, it is more important that you need an itemized list of everything shown on the reports. So that you can dispute any mistakes or misreported items. Keep in mind there are laws about what can appear on your credit report. Disputing these can double the rate your credit score rises, so you’ll achieve your goal of financial freedom much faster. Here are all the things that you need to dispute a credit report. Feel free to skip ahead if you already know this.

Major agency’s Dispute departments contacts

Of course, disputing items on your credit report can be a bit daunting. Here’s the contact information for each credit agency’s dispute departments:

If you would like to fill out a dispute form online, you can find the links here:

Equifax

Online: https://www.ai.equifax.com/

Experian

Online: experian.com/disputes/main.html

TransUnion

Online: dispute.transunion.com/dp/dispute/

If you would like to do a dispute by phone, the numbers for the credit bureaus are:

Equifax

Phone: (800) 864-2978

Mail: Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374

Experian

Phone: (888) 397-3742

Mail: Experian

P.O. Box 4500

Allen, TX 75013

TransUnion

Phone: (800) 916-8800

Mail: TransUnion LLC

Consumer Dispute Center

P.O. Box 2000,

Chester, PA 19016

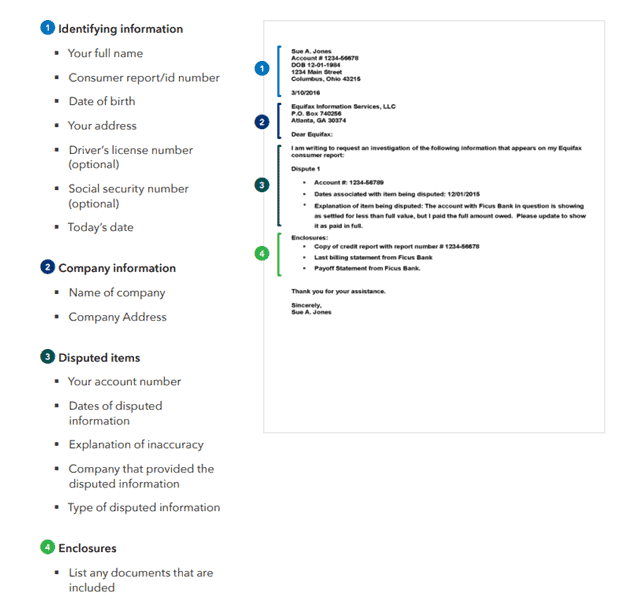

CFPB Simple letter to dispute credit report (609 credit repair)

The Consumer Financial Protection Bureau has an easy format (609 credit repair letter) with phrasing that will force these agencies to respond. It recommends mailing a copy of any documentation you have, along with your credit report from the agency and a copy of your driver’s license or government-issued ID card.

Using this simple letter format, you’ll strike fear into the heart of Big Brother:

Be sure to request a receipt copy so you have proof that your mailing was received. Therefore this simple step is the secret to winning against collectors in court. So it can save you literally thousands of dollars or more on your debts.

This is especially necessary with Equifax, which is known to be the most difficult of the three agencies to deal with. So if these agencies don’t respond the way they’re required to by law (which we’ll discuss in more detail below), don’t hesitate to fight Big Brother with an even bigger partner – the government. Because the credit score affects your life in many ways. What to do if the credit reporting agency refuses to fix your credit report.

You can dispute the debts directly with your creditors and also can force creditors to validate the debt. We will discuss the secret to defending yourself against collectors in another blog post. Get excited, because your life is about to change!

Simple steps to follow when starting disputing (Pro Tips)

1. Start with closed accounts

When disputing, start with closed accounts. If the account is open, there is a good chance that the creditor will verify it.

2. When disputing, Start with the oldest closed accounts first.

Many times, older accounts are sold or transferred multiple times, and the current debt collector does not have verification of the debt. Additionally, the equal credit opportunity Act only requires creditors to maintain written documentation for twenty-five months (see Chapter 15).

3. Look for duplicated accounts

Many times, the original creditor will report the account as derogatory and sell it to a collection agency, which will also list it as derogatory. Many times, the same single negative account can be on your report as many as two or three times. This is illegal. Simply dispute the accounts with the credit bureaus and inform them that they are duplicate accounts.

4. Scrutinize your credit report

Scrutinize your credit report for the accounts that are past the statute of limitation (seven years). The seven-year period now starts 180 days after the account is the first delinquent. However, it used to be from the date of the last activity. Congress has changed this so that debt collectors cannot continue to re-age old accounts.

5. Check your credit report for any misinformation or identity theft and dispute it accordingly.

How to dispute credit report – Other Effective Ways

Dispute Your Credit With These FCRA Loopholes – Credit Repair loopholes

You can use FCRA loopholes in your benefits. All these still work if you use them in a systematic way. For more details on how to use these FCRA loopholes, visit Fix Your Credit With These FCRA Loopholes.

Various excuses that are valid to dispute your debt

You should know the various excuses that are valid to dispute your debt and force your creditors to validate the debt so that it can remove from your credit report. For more details about what are valid excuses and how to use them for your benefits visit How do you force creditors to Validate Debt (and Excuse It).

Frequently asked questions (FAQ)

1. What to do if the credit bureau does not respond in 30 days?

Credit bureaus perform the most difficult task of collecting credit information. There is no perfect way of doing this because of human error, identity theft, or the unalterable nature of the credit reporting system. Due to this, bureaus may store ‘inaccurate, misleading, or biased information about millions of people on their credit reports. But what if the credit bureau does not respond in 30 days? Don’t worry, you can solve credit reporting complaints with all CRA’S.

In this regard, I am sharing with you practical experience. A few months back someone notices that three -fraud credit account is there in all three-credit reports of a different credit agency. Then he contacted all three CRA and they inform him that if these accounts are not belonging to him then inform the police and make a report.

Then he collects the police report from the local station. And then sends one copy of it to all the CRA along with the statement that the fraud accounts are not him, they should block the accounts immediately. Because of his request, Experian and Transition removed all fraud accounts, but Equifax started the “dispute” process.

2. What to do if the complaint is not solved with Equifax?

If your complaint is not solved with Equifax then what can you do? What if the credit bureau does not respond in 30 days? Here is another example of such kind of problem that I am going to share with you. Someone from Georgia sent a statement and police report to Equifax one month before. However, what happened to him after one month? Please stick to the context I am describing to you the full incident.

After one month, the dispute was complete and all 3-fraud accounts came back as belonging to him, which is a lie. The creditors are B.O.A, Capital One, and Macy’s. Then he filed a complaint with the Consumer Finance Protection Bureau (CFPB) against Equifax that initiate another dispute. After this, he has to wait for another 15 days for the outcome of his complaint to CFPB according to the CFPB guideline.

3. What to do When CFPB is not able to give the result?

If the Consumer Finance and Protection Bureau (CFPB) does not give you the result (They usually do in this case). Then sending EQ and ITS (Intent to sue) letters should be your next move is going to be, at this point, you need to wait for the CFPB to complete. Normally it had great success going the CFPB route. This is the way you exactly solve credit reporting complaints with all CRA’S.

Erroneous items on credit card reports often go unchallenged. Even though the FTC reports that 79 percent of consumer who disputed credit report errors was successful in removing them. Monitoring your credit score at regular intervals can be a good way to catch identity fraud.

If you invest a little time to overcome the hurdles put in place by creditors. Then you’ll transcend achieve your credit score and get the life of your dreams. This is how you could increase your credit score. More detailed advice is available on the Federal Trade Commission website.

0 Comments