Criteria for a Good Credit Score

Table of Contents

Your FICO credit score, created by the Fair Isaac Corporation, is used by lenders, creditors, landlords, and even employers to assess your credit risk. FICO scores range between 300 and 850. The criteria for good credit depends on what you’re applying for. Although 670 isn’t necessarily bad credit, it won’t be enough for a high-end condo rental or mortgage. It also depends on where you live.

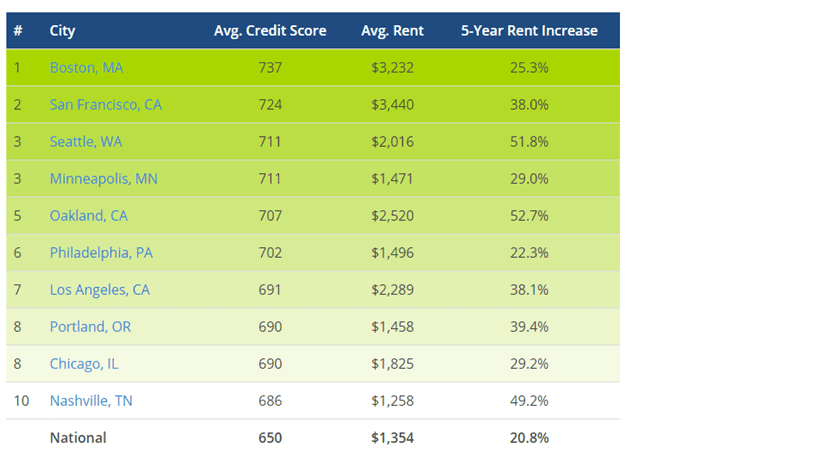

In cities like Boston, MA; San Francisco, CA; Seattle, WA; Minneapolis, MN; and Philadelphia, PA, the average credit score of renters is over 700. But in cities like Greenwood, MS; Albany, GA; Laredo, TX; or Riverside, CA, the average credit score is below 650.

Nowadays almost all business uses the FICO system to make lending decision quick and proper. And also used to check the financial health of their customer. The credit score is the only parameter that decides your financial health. So what is a good credit score?

What’s a good credit score?

Credit scores are used by lenders to calculate the risk of lending money. It’s a tool to help creditors determine how likely you are to repay their loans. Most of the major credit agencies in the United States use the FICO score to evaluate your credit health.

Your FICO score normally ranges between 300 and 850. So, what’s a good credit score? While each creditor may have their calculation, generally the following breakdown applies.

- A FICO score under 630 is considered Poor Credits

- An average or Fair score is between 630 and 690

- A good Score is between 690 and 720

- An excellent score is anything above 720

What Makes a Good Credit Score?

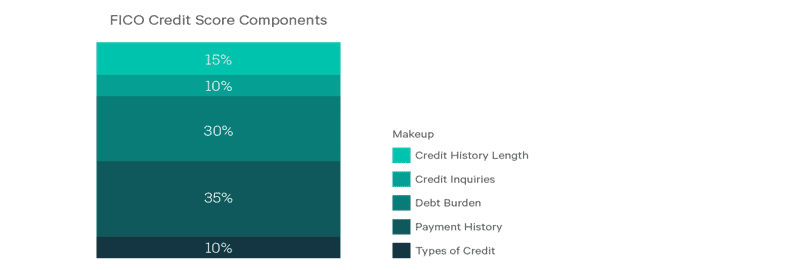

Your credit score is based on a secret algorithm designed by FICO, originally Fair, Isaac, and Company. The details of this algorithm are still hidden under a veil of secrecy even today. Though we do know the formula is generally comprised of the following five components or factors.

• Most Important factors – 35% Payment History

• Very Important factors – 30% Credit Utilization

• Somewhat important – 15% Length of Credit History

• Somewhat important – 10% Credit Inquiries

• Less Important factors – 10% Type of Credit Used

Related: Know these few things before they can hurt your credit score.

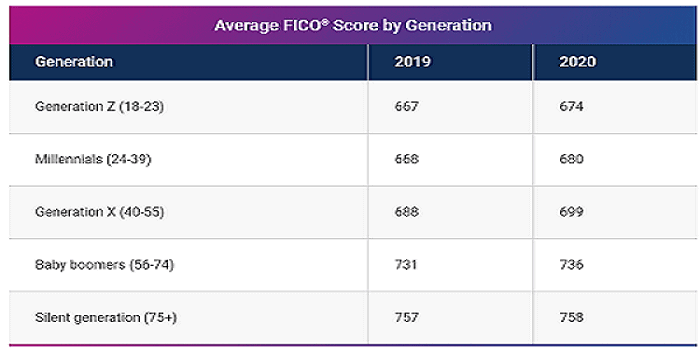

Average credit score by age group in 2021

Source: Experian

What are the Benefits of a Good Credit Score? To qualify for any mortgage loan your credit score mostly matters. You may save thousands of dollars in interest with a mortgage if you have a good credit score.

Why Having a Good Credit Score is Important

When you have a good credit score you can get the following benefits easily

1. Low-Interest Rates on All Types of Loans

2. Improved Approval Chances for Loans and Credit Card

3. Higher Credit Limits

4. More Negotiating Power

Credit Score Requirements for Rent Across the Country

Your credit score is one of the most important factors landlords use when deciding whether to rent to tenants. Here’s a chart showing the cities with the highest credit scores in the country, so you know what you’re competing against.

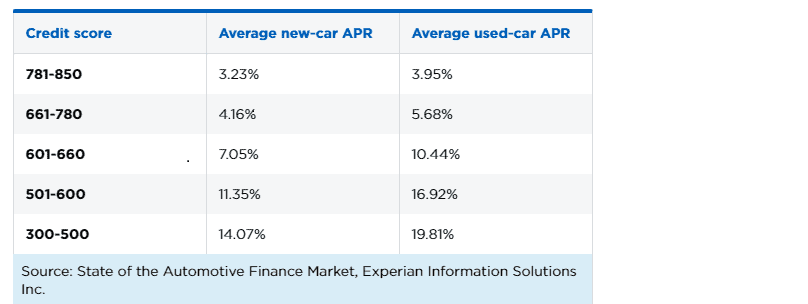

Experian recently released a study showing credit scores for new and used car buyers. The average recipient of a new-car loan has a 713 credit score, while the used-car loan average was 656.

Approximately 20 percent of borrowers got a car loan with credit scores below 600 and 5 percent had credit scores below 500. While people with these low credit scores were able to secure a car loan, they paid a lot more for it. So it’s very important to understand your credit score before applying for any loan or mortgage.

What Is a Good Credit Score for an Auto Loan?

Borrowers with good credit typically pay less selling price for the down payment. Borrowers with good credit typically only must pay $1000 or 10 percent of the selling price for a down payment. With bad credit, this doubles to 20 percent or more, and that’s not all. Here’s a breakdown of how credit scores affect the interest rates for car loans.

As you can see, a credit score of 700 will get you an annual percentage rate (APR) of 4.16-5.68 percent. Meanwhile, a 600 credit score nearly triples that of APR. I bet you didn’t realize your credit score was costing you so much.

Let’s say you get an auto loan for $10,000 for five years. With a 4.16 percent APR, you’ll pay a total of $11,204.22, assuming you’re never late with a payment. At 16.92 percent, you pay $15,034.61 by the end of your loan. Even with a higher down payment, you’ll end up with higher monthly payments and pay nearly 40 percent more by the end of your loan.

What Is a Good Credit Score for a Mortgage?

Mortgages have even higher credit requirements! You need a credit score of at least 740 to qualify for the best loans with the lowest down payment requirements (20 percent) and interest rates. Many lenders will qualify you for a conventional mortgage at 700, and some will even finance you as low as 620, although this is easier with VA– or USDA-backed loans.

Once your credit score drops below 580, your best bet for a mortgage is the Federal Housing Administration (FHA), but you’ll need a down payment of 10 percent. That’s much better than the 20 percent or more needed on a conventional loan. However, with an FHA loan, you’ll need more PMI.

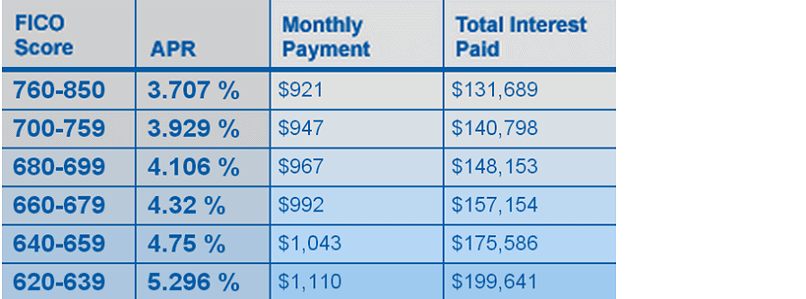

How much do mortgage interest rates vary with credit score

It will also affect mortgage interest rates. A FICO score of 700 can get you a 4.49 percent APR, whereas a 620 score comes with a 5.857 percent APR. Throughout a 30-year mortgage, that’s a difference of $60,000 on a $200,000 home. Of course, mortgage rates are always changing. As of August 2021, the average APR is 4.57 percent.

Here’s a chart showing the difference your credit score makes.

if you improve your credit score from poor to good, you will save

- $ 189 per month

- $ 2268 per year

So not only does a bad credit score require higher deposits and down payments, it increases monthly payments and total loan repayment amounts. Bad credit will come back to haunt you when you try to buy your dream home or a new car.

What Is a Good Credit Score for a Credit Card Approval?

Like other lenders, Credit scores are used by credit card lenders to calculate the risk of lending money. It’s a tool to help creditors determine how likely you are to repay their loan. Most of the major credit agencies in the United States use the FICO score to evaluate your credit health.

Your FICO score normally ranges between 300 and 850. While each creditor may have its calculation or parameter to determine its customer’s financial health. If you have a good credit score (more than 750) then only you will be approved for cards for the lowest rates and best rewards.

Depending on your credit score not only qualifies for a credit card, but your score also has a significant impact on the APR and other terms of your account.

How to protect yourself and maintain a good credit score

You should maintain the following things to maintain a good credit score. It will tremendously help you.

- Consistent Repayment

- Low Credit Utilisation

- Avoiding Multiple Credit Applications

- Build a good Credit History

- keeping your “old” credit cards or old accounts

- Avoid Paying Only Minimum Due

- Pay off your high-interest and “New” Credit Accounts First

- Maintain an Account for Diversity

- Check your credit report on a fixed time interval (for any Derogatory Mark, any error from Data Furnisher, or any Identity Theft)

If your FICO score is high then the possibility is you will get the approval of your loan or credit card easily with a much-reduced interest rate. Your lifestyle became so easy. You will get the freedom of credit and enjoy life as per your wish.

However, there is another possibility of just the opposite of this if your credit score is not good. So it’s better always to do things that affect the credit score. Feel free to skip ahead if you already know this.

If your FICO score is low then the door to your happiness is close all around you. You will never get your dream house, even not in your lifetime. It also restricts you to access a product or services offered by the bank or other financial institutions.

You should be well aware of these factors to Protect your FICO score from decreasing

Five Factors that affect credit score

Your FICO score can be split into a few major factors like payment history (35%), Debt Burden (30%), Length of History (15%), Types of Credit (10%), and Recent Credit Searches (10%). I will discuss with you how this factor is affecting your credit score. Feel free to skip ahead if you already know this.

So, in a nutshell, the largest component of your score, Payment History, looks at missed or late payments. Credit Utilization subtracts the amount owed from your credit limit. Length of Credit History looks basically at the Average Age of Accounts (AAoA) and how long it’s been since they were used.

Credit Inquiries or “Hard inquiries” happen when you authorize a creditor to check your score. Finally, by Type of Credit Used, they mean Credit Mix. They like to see a variety of different types of credit account types, e.g., revolving, installment, and open.

Effects of late payment on your score

You can consider payment history as a record of all the things you did wrong related to your credit and how you behave toward your debts. Late payments are directly related to payment history. So late payment is the most common thing among consumers and it creates a tremendous effect on your credit score.

Suppose you make a thousand-dollar payment for various credit cards but you forget to make a payment for $50 for a single credit card. It will hurt your credit score dramatically. The longer time you are late for the payment, the more effect on your score. So be careful about things that affect your credit score negatively.

A single late payment could have a significant effect on your credit score if you hold a higher credit score

According to the FICO data, a 30-day late payment could hurt you as much as a 90 to 110-point drop in your FICO credit score. Provided that you have an initial score of more than 780 and you never missed a payment on a credit card.

For example, a consumer with only two late payments history and an existing 680 FICO score could drop 60 to 80 points in his score after being hit with a fresh 30-day late payment on any of his credit accounts. (one is two years ago a 90-day late payment on a credit card account and the second one is approximately one year ago a 30-day late payment on an auto loan account)

How does collection affect your score?

If you fail to pay your debt before the 90-day late payment period then your debt is sold to a third-party collection agency or internal collection department. It will update your credit reports and your score will suffer.

Are you thinking about how the collection may affect your credit score? Do not worry, we can help you in this regard and you can bring back your credit points. You may be surprised by what is on your credit report. It may be something from years ago like an old cable bill that you missed when you moved. That happened to me when I received a collection notice for $156 for an old Comcast bill from a house I’d moved from several years ago and didn’t even know about it.

One collection notice on your report may down the score by 100 points

That one collection notice on my report was driving my score down by maybe 100 points. That was an honest mistake. Whenever you see a collection account on your credit report, you feel uncomfortable thinking that this account hurts your credit score. You will see this account in your credit report each time a collection agency reports debts to credit bureaus. Thus, these affect your credit score negatively.

However, there are some ways to get the thing sorted out. And you should always try to stay on top of all three credit reporting agencies. To avoid damages to your credit score by the collecting account keep reading to find out how the collecting agencies work.

Collections can be removed

The amount of collecting debt does not affect your credit score. For your better understanding if you have a debt of $500 it reduces your credit score by 50 points. A $1000 debt also reduces the same amount of points – 50 points from your current credit score.

There will be a major reduction in your credit points when the first time’s collection account reports. After that, each additional collection will have a limited effect on your credit score.

Removing a collection account will usually boost your credit score

It’s always good to stay on top of all three credit reporting agencies. When you contact a collector for settlement, you should try to agree with them to a “payment for deletion”. There is a good chance it will help to boost your score. You have to check whether you paid the collection or removed the collection account, and in both cases how many points you can earn.

In this regard you have two options: 1) A mortgage company can pull your credit in the last 30 days and they can run such a simulation. or 2) you can sign up for a three bureau-monitoring site for www.privacyguard.com and run the analysis.

These scores are consumer scores, not the FICO score but they help you to decide which collection(s) should you try to pay or delete based on the potential score improvement. Of course, there may be another reason to pay for a collection. But if you are looking for score improvement, follow the instructions above or call us – we always use these tools. Not all agencies will agree to pay for deletion.

What to do When Charge off has a highly negative impact on your score

A creditor will charge off your account after 180 days of no payments when you do not pay anything to debt. A charge-off has a highly negative impact on your score. It stays on your report for 7 years from the date it missed the payments.

The creditor often uses a third-party debt collector to attempt to collect payment after an account has been charged off. The original creditor may hold the account but assign it to a third party for collection. In this case, the original charge off with the balance will be reported. However, a new collection account will report to your credit file if the creditor sells the debt.

Solve the problem with the original creditor before they sell the debt

Now you have two major negative items on the same debt, a charge-off, and a collection. It is a good idea to solve the problem with the original creditor before they sell the debt and the collection account shows up.

The first collection can cost you 100 points negative if your credit score is in the 700s. If you have lower scores and other negatives. Then the new collection has less effect on your credit score. But it is still significant. So it’s a good idea to take care of things that affect the credit score.

Hard inquiries may affect your Score

Applying for new credit may affect your credit score but depends on each person’s credit history. In general, there is very little effect on your FICO score. One additional credit inquiry (hard) may result in five negative points in your score.

Hard inquiries are those, generated when you apply for new credit and your lender requests for your credit to a credit bureau. Even if your credit score changes by inquiry, it will list factors that affect your credit score.

Therefore, Inquiries from potential creditors are considered against you, but your request does not have any impact on your score. But you should always try to stay on top of all three credit reporting agencies. Do not apply randomly for your credit cards.

Before applying to do your homework, Compare rates, terms, and features offered by the lenders and then only apply. It is not just you, and it’s not your fault. It happens to all of us. One study showed over 34% of Americans had 620 or lower “Bad Credit” scores. Maybe they had a health issue, maybe they were in between jobs.

Related: Dispute credit report with the credit reporting agency