How to secure your future financially

Table of Contents

How you secure your future financially depends on your current age, your current income, and your retirement age. To understand how to achieve financial security, you need to first understand what will be the main expenses once retire. Achieving financial security is a long-term process and needs a disciplined approach to achieve it. Here we going to discuss a step-by-step plan for how to secure the future financially.

Now assume that you have no dependents, and your home/car/other loans are paid off. Basically no long-term liabilities. So here is the list of major expense heads for most middle-class families. The list may be changed as per personal choices but these are the most commonly considered.

• Daily/Monthly running expenses for food, transportation, utilities, communication, TV/cable, maidservants, etc.

• Occasional expenses for once a month or for cinema, eating out, etc.

• Your annual expenses for medical insurance, car insurance, property taxes, housing society AMC, etc.

• Vacations and holidays as and when

Steps to financial security

Now you have a list of expenses and you need a solid plan that actually works to secure your future. The Steps to financial security planning are as below but it may need a little bit of flexibility depending on the person-to-person personal financial condition. But the overall idea will be the same as described below.

- Start as Early as Possible

- Goal Planning and Achieving

- Manage your Financial Goals

- Purchase a sufficient amount of Insurance coverage

- Build Emergency Funds to secure your future

Start as Early as Possible

It is not necessary to start your all goals at the same time. You can set your own priorities to secure your future. For instance, For someone buying their own home is important. For others, retirement planning is important for a secure future.

The important is to start planning as early as possible in life. Learn the advantages of compounding. For example, Just ₹ 10,000 SIP per month invested for 20 years in a good MF that returns 10% on an annual YoY basis can create a corpus of ₹ 76.57 lakhs (your own contribution is ₹ 24,00,000).

A lot of contribution towards each goal depends upon the current net take-home salary (all earning members). Hence setting priorities is important.

Goal Planning and Achieving

If your goal is not realistic and clear enough then everything down the line will mess up because your goal is a decided factor of many things related to your investment. For instance, which type of instrument do you need to choose to achieve your goal, what will be the risk profile of your investment, etc? Now how to decide all these, we will discuss it later. So whenever you decide your goal you should be specific on two things. Every goal you decide on must have two components, I am repeating these must have two components:

- Time duration: You have to be specific about the time duration of your investment. But keep in mind that it should be realistic so that your desired amount can be achieved considering your risk profile and realistic expected return on the instrument you have invested in.

- Maturity amount: You need to calculate your inflation-adjusted maturity amount, it is crucial to consider inflation when calculating your maturity amount. It does not matter how much will be the maturity amount because your maturity amount can be achieved by adjusting your risk profile and time duration. For more details step by step process of goal planning and achieving discuss in the blog post how to Plan your investment.

Now plan and assign inflation-adjusted values to the goals. For instance, at the age is 30, A family with 2 parents, a spouse, and one child having monthly expenses is ₹ 35,000 today (rent and EMIs or insurance are not considered), then 28 years later, at a 6% inflation rate, the figure reaches approximately ₹ 1,79,000 pm.

But at the age of sixty, your family member may be just 2 (you and your spouse). So this figure may be reduced by some amount – let’s say ₹ 1,50,000 pm or ₹ 18,00,000 per year. This is in the 58th age year. I assumed that the life expectancy is 80 years then it will continue to grow with inflation.

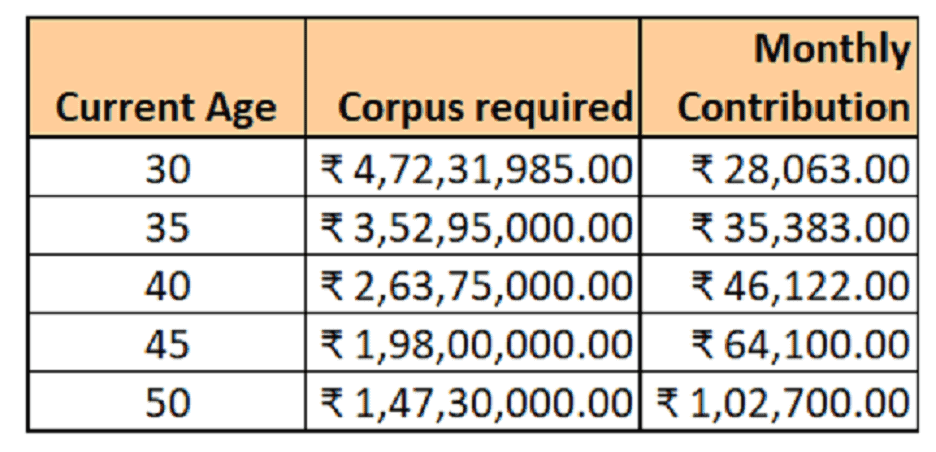

So for this single goal, depending upon age you will need to invest as follows (assuming a 10% return on investment):

The above corpus will last till the age of 80.

Managing Financial Goals is very crucial to secure future financially

Next comes individual financial goals. Each goal must be independently planned. Here is a list that includes a few financial goals. It will help you to determine your set of goals.

- Buying a home for self-occupation or as an investment

- Buying the dream car

- education of children (Bachelors’s and Master’s degree)

- Children Marriage

- Vacations abroad (optional)

- Retirement (the final and most important goal)

The value of each goal will depend on your current age, the goal age, and the inflation rate of the country. Let’s consider that the current inflation rate is around 6% and it is constant. Here are a few things I am going to explain to you just to give you an idea of how to manage your goal because everyone’s goal is different and hence needs to be managed differently. Let’s say you need to manage the goals (1) and (2) as mentioned above.

- Renting can be cheaper than buying. But the problem is, that rent will rise and it is a pure expense. There is a lot of uncertainty because the landlord may not renew the lease. Due to these uncertainties, you cannot plan your furniture as per your wish, appliances, and interiors to your liking. And finally, at the end of every year, you are not paying off to build your asset.

- We suggest you look for a resale property, especially a distressed sale. These kinds of properties are easily available at a discounted price and for the same budget, one can either plan for property and interiors or buy a larger size or get closer to the center of the city.

- You may have a plan for a new car but you should know that car is a heavily depreciating asset. As soon as you drive the car out of the showroom, it will be depreciated by 5% of its on-road price. My advice is don’t buy a new car instead go for a used one.

- The following exercise may help you:

- Every day note down the expense. Even the smallest expenses such as tea, cigarettes, snacks, etc. must be noted down as Debits.

- Every expense/debt should be classified as essential, nice to have (once in a while), totally unnecessary, and extravagant.

- Make a sheet with a pivot table on expenses (essential, OK to have once in a while, extravagant).

- Reduce the extravagant and even “OK type” expenses.

- Try not to eat outside too often

- Try to reduce the number of visits to the multiplex and cinema

- If possible try to find cheaper subscriptions to TV/DTH, mobile/internet, etc.

- Try to use a carpool; it is good for the environment and also

- You need to think and find out where to cut down

- Follow this rule strictly Net Monthly Income – EMIs – Compulsory Savings into Investments = Money left for Expenses. Most people do not follow this rule rather they just do the opposite. After doing all the expenses, if there is money left then they do save.

Purchase a sufficient amount of Insurance coverage to achieve financial security

You should not mess up insurance with Investment. It advises not to mix insurance with investment; do not confuse endowment as an investment. I already discussed in detail in the post that guaranteed or assured return plans are really good options for investment. It strictly advocates that you go for Pure Term Insurance for insurance.

- Purchase pure-term insurance for every earning member – typically husband or wife. You must start with the sum assured value of rupees 1 crore for the term insurance and increase as the age increases. In general sum, the assured value should be between fifteen to twenty times more than your current CTC. Stop the term insurance once you retire or each earning member retires.

- Set up comprehensive medical insurance that covers all members of your family. also, check if parents are covered or not. Your medical insurance should not have any sub-limits such as an ICU cap, room rent cap, Ambulance expense limit, etc. Each member should cover at least a sum of ₹ 5 lakhs at today’s cost. This must increase every 5 years.

- Besides comprehensive health insurance, you must also have a family floater top insurance of twice the value of comprehensive insurance with a deductible. It must cover all family members. For instance:

- you should ensure each family member for ₹ 5 lakhs each

- also, add-on top-up insurance should be ₹ 10 lakhs

- with ₹ 5 lakhs as deductible.

- In any situation, if you run into a major medical emergency, your first line of cover is the employer’s insurance. If that gets exhausted, use personal insurance. If that also gets exhausted in any case then use the family floater top-up.

- Family floater top plans are quite cheap.

Include Emergency Funds in Your financial security planning

After planning for the insurance your second step should plan for emergency funds:

- Emergency Job Loss Fund: This fund protects you from sudden job loss and keeps you running while you hunt for a new job. The amount must be 6 months of gross (or net) take-home pay. As you get older, plan for a longer/larger fund because it will be difficult to find a job and then cap it to a maximum of one year of pay.

- Parent’s medical emergency: You also consider a parent’s medical emergency if parents do not have any medical insurance, have no own funds, etc. The amount should be at least ₹ 3 lakhs per living parent at current costs.

The above funds must be kept in a Liquid MF (better than bank FD) and must not be touched. I hope this helps you all. I welcome comments and views from you.

0 Comments