Why is it so important to understand the factors that affect credit score

Table of Contents

In school, you were always told about things going on in your permanent record. The only permanent record you have as an adult is your credit score. However, your credit score does follow you around everywhere you go.

It decides whether you can get a loan to buy a car or house. It impacts your interest rates and insurance premiums. A bad credit score forces you to pay expensive deposits for rent, utilities, and mobile phone service. It can even affect whether you get a job or a promotion.

Bad credit is like a black cloud hanging over you everywhere you go. It’s overwhelming and fills many people with uncertainty. But you don’t need to passively accept bad credit. Stop holding yourself back with fear and doubts. Debt can be conquered.

Up to this far, you understand that it is extremely important to understand what are the factors that affect your credit score so badly and need to check your report in a fixed interval of time. For this, you need to get a free copy of your credit score. Now comes the next part.

How to get a free annual credit report

Your credit score affects your life in many ways. So the only way to improve your credit and protect yourself and your money is to stay on top of Big Brother. All three agencies are required by federal law to provide you with a free annual credit report at your request once every 12 months. You also have 60 days to report a free copy if you’re denied credit, insurance, or employment based on bad credit. To order, visit annualcreditreport.com or call 1-877-322-8228.

Most important factors in credit score

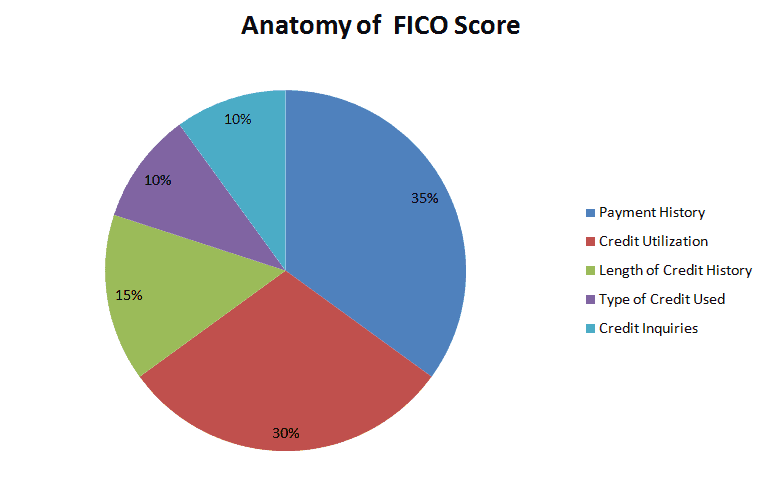

Your FICO Score Component

Sometimes you will be in wonder why is my credit score going down after a certain time. Why would my credit score drop? First, what are the components of your FICO score anyway? Your credit score is generally comprised of the following five components. These components have a very important role in your credit score. You could say, these are the main factors that determine credit score. Next, we are going to discuss that.

- 35% Payment History

- 30% Credit Utilization

- 15% Length of Credit History

- 10% Credit Inquiries

- 10% Type of Credit Used

Why does credit score vary across credit bureaus?

To make the lending decision quick and properly more than 90% of business uses the FICO system to know the financial health of their customer. The biggest three credit reporting companies in the United States Market are Experian, TransUnion, and Equifax.

Each credit reporting company set its own standard and business model because of this each of them makes their own changes to formulas according to their own rules. This change causes your credit score may vary a little bit for different reporting companies. However, there are various ways to improve credit scores.

Five other Factors that affect credit score

Payment history (35%)

This means the bulk of your credit score is made up of on-time payments and how much available credit you have. If you pay all your dues, credit accounts, and loans on time each month then you are in a good position. How you handle your debt and how well you pay them is the most important factor that affects your credit score.

If you miss any payment then a single late payment could have a significant effect on your credit score if you hold a higher credit score. According to the FICO data, a 30-day late payment could hurt you as much as a 90 to 110 points drop in your FICO credit score. Provided that you are an initial score of more than 780 and you never missed a payment on a credit card.

Debt Burden (30%)

Many experts will tell you to stick to 30 percent of your available credit. I recommend keeping your available credit at 94 percent. You should only be spending $6 for every $100 of available credit you have. In short debt burden is the other most important factor that affects your credit score.

If you want to successfully raise your credit to the best possible score. So in practice, your credit limit will be five to six times high than your usage limit to game the system. This lowers your credit risk and makes you someone lenders love to work with. I know only six percent spending will not give you a chance to increase your credit limit. For this, I already discuss a trick to increase credit limit quickly in the blog post Optimization of your debt ratio.

Length of your credit history (15%)

The length of your credit history contributes 15 percent of your FICO score. This is a relatively less weighted factor in all other factors that affect credit scores.

Normally it takes six months of payment history to establish a credit score. In general, the longer the history, the more effect on the score.

So, in a nutshell, among all the factors that affect credit score, the largest component of your score, Payment History, looks at missed or late payments. Credit utilization subtracts the amount owed from your credit limit. Length of Credit History looks basically at the Average Age of Accounts (AAoA) and how long it’s been since they were used.

Credit Inquiries or “Hard inquires” happen when you authorize a creditor to check your score. Finally, by Type of Credit Used, they mean Credit Mix. They like to see a variety of different types of credit account types, e.g., revolving, installment, open.

Hard inquiries may affect your Score (10%)

Hard Inquiries are the less weighted factor in all other factors that affect credit scores.

Applying for new credit may have an effect on your credit score but depends on each person’s credit history. In general, there is very less effect on your FICO score. One additional credit inquiry (hard) may result in five negative points in your score.

Type of Credit Used (10%)

One of the most common factors used to calculate your credit scores is Credit mix or the diversity of your credit accounts. Maintaining different types of credit accounts, such as a mortgage, personal loan, and credit card show lenders that you are a potential customer who can manage different types of debt efficiently. It also helps them get clearer information about your financial health and the potential to pay back debt.

Other factors that affect your credit score

Defaulting on accounts can affect your credit

Various types of negative information like foreclosure, bankruptcy, repossession, charge-offs, and settled accounts can show up on your credit report. Each of these negative items can severely hurt your credit for years, even up to a decade.

Can Service Accounts Impact My Credit Score?

Service accounts like utility bills, and phone bill payments don’t have any direct effects on the credit score but if you miss any payment and the account was referred to a collection agency then it could affect your credit score. But there is good news a new product called Experian Boost allows users to get instant credit for on-time payments on utility and telecom accounts.

There are a few more factors that affect credit scores. These are the less important factors but are still quite important.

- How the credit reporting agencies collect and maintain your credit information

- What information does CRA collect

- How is your fico score calculated

Now let’s talk about small things you can do that can potentially make a big impact on your score to change your life!

factors that impact credit score for a long time

What next if the credit bureau does not respond in 30 days

No Credit Check Loans and Cryptocurrency – an opportunity to start

Read more

Piggyback Hack to Boost Score – Sometimes 100+ Points

Read more

0 Comments