Credit loophole to raise score here’s what you need to know to master these explosive secrets

Table of Contents

Fix Your Credit With These FCRA Loopholes – Credit repair loopholes

Previously We’ve discussed collection laws, but how creditors treat your credit report is also regulated by federal law, specifically the Fair Credit Reporting Act. There are three important sections of the FCRA that can help you clean up your credit: Sections 604, 609, and 623. Therefore all these three sections may use as credit loopholes to raise scores if you use them correctly.

Section 604 – Permissible purposes of consumer reports

Legal credit score loopholes – how to take benefits of it

When a financial institution, landlord, or employer checks your credit report, it’s called a hard inquiry. These hard inquiries could lower your credit score and cause you to be denied credit. Especially when you made multiple hard inquiries in a short time span.

Section 604 provides guidelines for what constitutes a permissible hard inquiry, including a signed contract from you. You can easily find the Fair Credit Act 604 form online. What most people don’t know is these hard inquiries aren’t typically tracked by the credit agencies themselves. Instead, they use a third-party company called SageStream to track this data. This gives you a chance to help your credit score.

Contact SageStream on their website to request a security freeze on your information. This will stop them from reporting hard inquiries to credit agencies. Subsequently, it may help to raise your credit score by a few points. It is always advised that you hire an advisor and discuss all these prospects in detail.

Fair credit reporting act section 609 loophole – Disclosures to consumers

Legal credit loophole – how to take benefits of the 609 credit loophole

On top of the FDCPA letters you send to collectors, you should also send an FCRA 609 letter to credit agencies. This piles the work onto the creditors and makes their lives more difficult. They now must respond to both your request and the credit agency’s request.

If the collector or credit agency doesn’t respond within 30 days, you now have a paper trail of them not working with you. You can send a non-response letter to have the items removed from your credit report. If it’s not removed, report it to the Better Business Bureau, FTC, or CFPB, and consider civil action in court. That’s all about section 609 of the Fair Credit Reporting Act loophole.

Section 623 – Responsibilities of furnishers of information to consumer reporting agencies

legal loopholes credit repair – how to take benefits of it

You would think creditors would keep accurate records of all information and accounts, but this isn’t the case. They often lose information, and this is the most solid defense used in foreclosure cases. Most of the time the mortgage company can’t provide the original paperwork and the court dismissed the case.

After you’ve disputed the negative credit items with the credit agency using Section 609 letters, Section 623 letters force the creditor to prove the debt is valid. If they can’t, you have legal grounds to pursue civil action in court, and following these three sections in order give you a solid defense to not only have your credit report corrected but also receive financial compensation for damages caused. You may continue reading to know more about other credit loopholes, these are not illegal credit repair tactics you may skip ahead if you already know.

Section 605 – derogatory information verification (credit secret loophole)

Legal credit report loopholes – how to take benefits of it

If the accurate derogatory information in the consumer’s file cannot be verified, the reporting agency is required to remove it. Not just for the original company, this law required all the companies that report negative credit events to produce verifiable proof of the negative event. It cross-checks the accountability of credit reporting agencies for the negative information they pass on.

Section 605 can be used as a credit secret loophole. Here are the details on how to use it. Due to these legal credit loopholes, the reporting agencies need to investigate and remove any disputed, negative item from your credit report within 30 days if it cannot be verified. The only way to find out Mr.Mclnnis challenging the credit bureaus is to verify the negative credit events in the credit reports of his clients is by producing a copy of the original creditor’s documentation.

He did not challenge the correctness of these events. He just used a legal strategy to challenge the credit bureau’s ability to verify its correctness. They have no right to continue to maintain it on their credit reports if they cannot verify it. In addition, credit bureaus began to comply. They remove the negative events from the credit records.

Some simple steps to file a dispute using these Credit Repair Loopholes that can help you to start

1. When disputing, start with closed accounts.

If the account is open, there is a good chance that the creditor will verify it.

2. So when disputing, Start with the oldest closed accounts first.

Many times, older accounts are sold or transferred multiple times. and the current debt collector does not have verification of the debt. Additionally, the Equal Credit Opportunity Act only requires creditors to maintain written documentation for twenty-five months (see Chapter 15).

3. Look for duplicate accounts

Many times, the original creditor will report the account as derogatory and sell it to a collection agency, which will also list it as derogatory. Many times, the same single negative account can be on your report as many as two or three times. This is illegal. Simply dispute the accounts with the credit bureaus and inform them that they are duplicate accounts.

4. Scrutinize your credit report

Scrutinize your credit report for the accounts that are past the statute of limitations (seven years). The seven-year period now starts 180 days after the account is the first delinquent. However, it used to be from the date of the last activity. Congress has changed this so that debt collectors cannot continue to re-age old accounts.

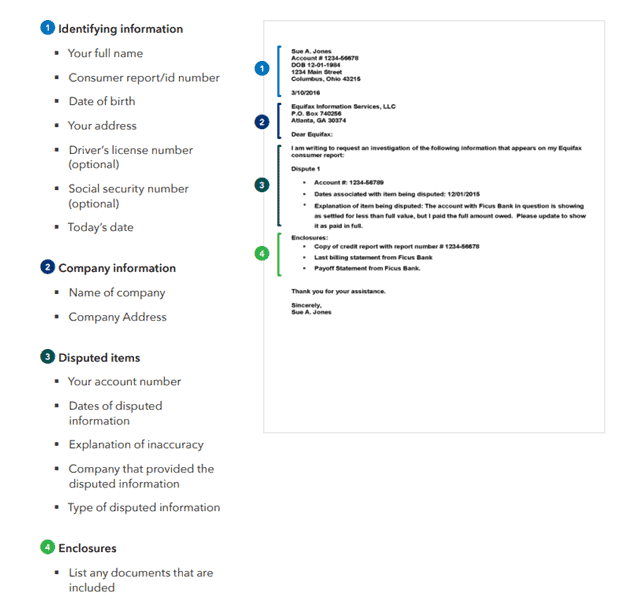

Section 609 credit report dispute letter Sample

The Consumer Financial Protection Bureau has an easy format with phrasing that will force these agencies to respond. It recommends mailing a copy of any documentation you have, along with your credit report from the agency and a copy of your driver’s license or government-issued ID card.

Using this simple section 609 credit report dispute letter format, you’ll strike fear into the heart of Big Brother:

Be sure to request a receipt copy so you have proof that your mailing was received. Therefore this simple step is the secret to winning against collectors in court. So it can save you literally thousands of dollars or more on your debts.

This is especially necessary with Equifax, which is known to be the most difficult of the three agencies to deal with. So if these agencies don’t respond the way they’re required to by law (which we’ll discuss in more detail below), don’t hesitate to fight Big Brother with an even bigger partner – the government. Because the credit score affects your life in many ways. What to do if the credit reporting agency refuses to fix your credit report.

I can’t stress enough that you need to keep documentation of every and all contact with your creditors to be successful in court. That one trick will change your entire life. Of course, what credit you choose to accept can impact your life too. So that’s what we’ll talk about next.

Related: Know Which Credit Cards to Use and Avoid when you have bad credit

0 Comments