Is a 638 credit score good or bad?

Table of Contents

Credit scores are used by lenders to calculate the risk of lending money. It’s a tool to help creditors determine how likely you are to repay their loan. Most of the major credit agencies in the United States use the FICO score to evaluate your credit health.

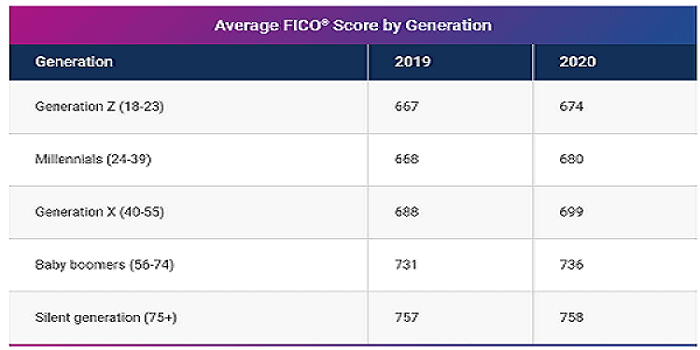

Your FICO score normally ranges between 300 and 850. So, What’s a good credit score? Is a 638 Credit Score good or bad? While each creditor may have their own calculation, Your FICO credit score, created by the Fair Isaac Corporation, is used by lenders, creditors, landlords, and even employers to assess your credit risk. A FICO score of 638 is considered an average or fair Credits score.

Is 638 a good credit score for qualifying loans, mortgages, and credit card

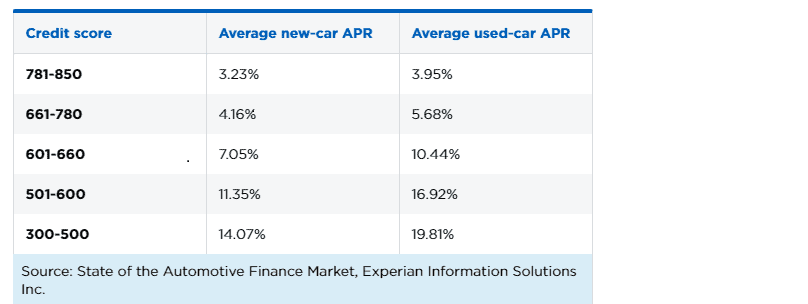

The criteria for good credit depends on what you’re applying for. Although a 638 credit score isn’t necessarily poor credit, it won’t be enough for a high-end condo rental or mortgage. It also depends on where you live. In cities like Boston, MA; San Francisco, CA; Seattle, WA; Minneapolis, MN; and Philadelphia, PA, the average credit score of renters is over 700. But in cities like Greenwood, MS; Albany, GA; Laredo, TX; or Riverside, CA, the average credit score is below 650. The Average credit score by age group in 2021

Source: Experian

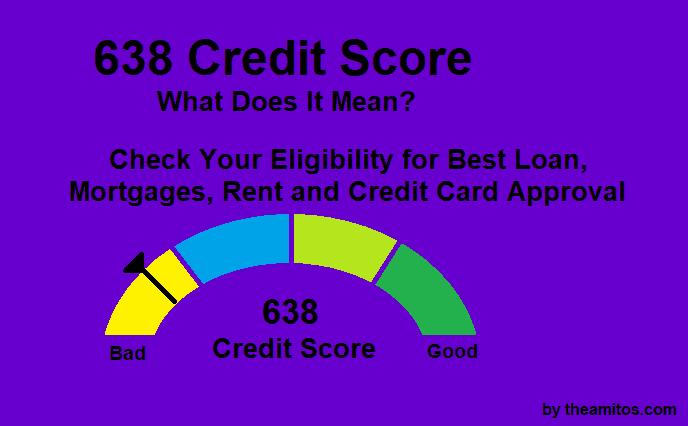

638 Credit Score Car Loan Opportunity

Experian recently released a study showing credit scores for new and used car buyers. The average recipient of a new-car loan has a 713 credit score, while the used-car loan average was 656. Approximately 20 percent of borrowers got a car loan with credit scores below 650 and 5 percent had credit scores below 500. While people with these low credit scores were able to secure a car loan, they paid a lot more for it. So it’s very important to understand your credit score before applying for any loan or mortgage.

Selling price needed to pay for the down payments if borrowers have a 638 credit score

Borrowers with good credit typically pay less selling price for the down payment. Borrowers with good credit typically only must pay $1000 or 10 percent of the selling price for a down payment. With bad credit, this doubles to 20 percent or more, and that’s not all. Here’s a breakdown of how credit scores affect the interest rates for car loans.

Interest rates for car loans

As you can see, a credit score of 700 will get you an annual percentage rate (APR) of 4.16-5.68 percent. Meanwhile, a 638 credit score nearly triples that of APR. I bet you didn’t realize your credit score was costing you so much. The above statistics show that it is not necessarily 638 Credit Score is good but all you need is a little bit of boost to your credit score.

Let’s say you get an auto loan for $10,000 for five years. With a 4.16 percent APR, you’ll pay a total of $11,204.22, assuming you’re never late with a payment. At 16.92 percent, you pay $15,034.61 by the end of your loan. Even with a higher down payment, you’ll end up with higher monthly payments and pay nearly 40 percent more by the end of your loan.

A detailed comparison of how much more an auto loan will cost for someone having a 570 credit score versus a credit score of 650.

Let’s take a close look:

| Loan Type | Credit Score | Rate | Payment | Added Cost |

| 36-month new auto | 650 | 9.31% | $862 | $0 |

| 570 | 14.80% | $933 | $2,550 | |

| 48-month new auto | 650 | 9.33% | $676 | $0 |

| 570 | 14.81% | $749 | $3,491 | |

| 60-month new auto | 650 | 9.40% | $566 | $0 |

| 570 | 14.822% | $640 | $4,443 |

638 credit score mortgage opportunities

Mortgages have even higher credit requirements! You need a credit score of at least 740 to qualify for the best loans with the lowest down payment requirements (20 percent) and interest rates. Many lenders will qualify you for a conventional mortgage at 700, and some will even finance you as low as 620, although this is easier with VA– or USDA-backed loans.

Once your credit score drops below 638, your best bet for a mortgage is the Federal Housing Administration (FHA), but you’ll need a down payment of 10 percent. That’s much better than the 20 percent or more needed on a conventional loan. Although with an FHA loan, you’ll need more PMI.

FHA Loan with a 638 Credit Score

With a 638 credit score, you can qualify for FHA loans. Other FHA loan requirements are that you have at least 2 years of employment, and you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% (unless you have satisfactory “compensating factors”, such as a higher down payment, or cash reserves). The reason behind the popularity of FHA loans is that the down payment requirement is only 3.5%, and it can be borrowed, gifted, or provided through a down payment assistance program.

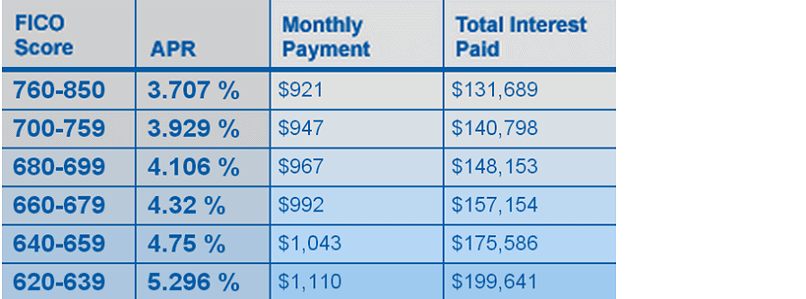

How much do mortgage interest rates vary with a 638 credit score

638 Credit score also affects mortgage interest rates. A FICO score of 700 can get you a 4.49 percent APR, whereas a 620 score comes with a 5.857 percent APR. Over the course of a 30-year mortgage, that’s a difference of $60,000 on a $200,000 home. Of course, mortgage rates are always changing. As of August 2021, the average APR is 4.57 percent.

Here’s a chart showing the difference your credit score makes.

if you improve your credit score from poor to good, you would save

- $ 189 per month

- $ 2268 per year

Let’s assume that you may qualify for an FHA loan with a 638 credit score. Now check the charts below:

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4.31% | $1,487 | $0 |

| 700-719 | 4.53% | $1,526 | $14,040 | |

| Moderate | 675-699 | 4.71% | $1,558 | $25,560 |

| 620-674 | 4.93% | $1,597 | $39,600 | |

| Bad | 570 Credit Score | 5.36% | $1,676 | $68,040 |

So not only does a bad credit score require higher deposits and down payments, it increases monthly payments and total loan repayment amounts. That’s why it’s important to maintain a good credit score. Bad credit will come back to haunt you when you try to buy your dream home or a new car.

638 credit score Credit Cards options

Like other lenders, Credit scores are used by credit card lenders to calculate the risk of lending money. It’s a tool to help creditors determine how likely you are to repay their loan. Most of the major credit agencies in the United States use the FICO score to evaluate your credit health.

Your FICO score normally ranges between 300 and 850. While each creditor may have its own calculation or parameter to determine its customer’s financial health. If you have a good credit score (more than 750) then only you will be approved for cards for the lowest rates and best rewards.

For a poor credit score or if you have a 570 credit score then you will qualify for the secured credit card. To qualify for an unsecured credit card, you need a minimum credit score of 600. It also depends on what type of credit card you are applying for.

Depending on your credit score not only qualifies for a credit card, but your score also has a significant impact on the APR and other terms of your account. The charts below show the differences in the interest rate and annual fees between someone with a good credit score and a credit score of 570.

| Card Type | Score | Rate | Balance | Added Cost |

| Platinum | 720-850 | 4% | $5,000 | $0 |

| 700-719 | 6% | $5,000 | $362 | |

| Gold | 675-699 | 8% | $5,000 | $774 |

| 620-674 | 10% | $5,000 | $1,250 | |

| Standard | 570 Credit Score | 16% | $5,000 | $3,240 |

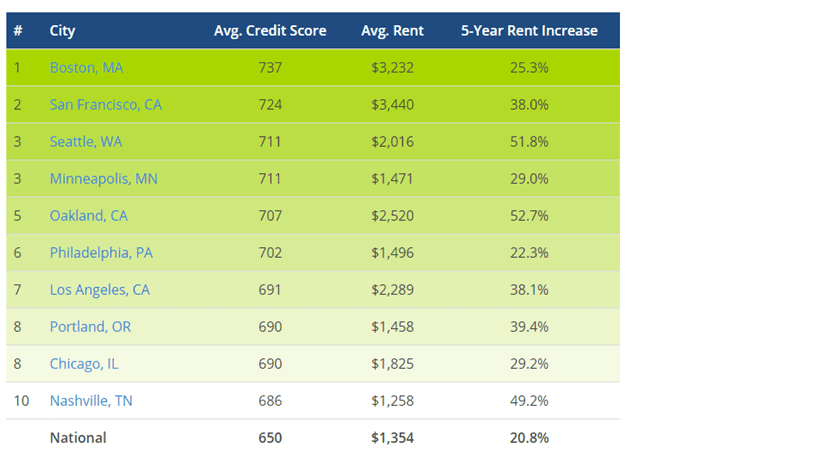

List of city-wise highest average credit scores for rent in the country

Your credit score is one of the most important factors landlords use when deciding whether to rent to tenants. Here’s a chart showing the cities with the highest credit scores in the country, so you know what you’re competing against.

City-wise Avg. Credit score for Rent

Frequently Asked Questions (FAQ)

Can I get a Jumbo loan with a 638 credit score?

To qualify for a jumbo loan the minimum credit score depends on the lender. Most jumbo lenders prefer a credit score of at least 720 to offer a jumbo loan. However, you can get a jumbo loan with a credit score of 600 from non-prime lenders. Therefore the chance of getting a jumbo loan with a credit score of 638 is possible.

What do non-prime loans offer?

Non-prime loans provide an opportunity to get a mortgage for borrowers that do not qualify for conventional and FHA loans. They have much less strict credit requirements, including no waiting periods after bankruptcies, foreclosures, and short sales. Non-prime loans also are available to borrowers with credit scores as low as 500 (or even below 500).

Should I qualify for a home loan if I have a major credit issue last year?

If you have had a bankruptcy, foreclosure, or short sale, there are several non-prime lenders that offer home loans to borrowers even just 1 day after such events.

What are other credit requirements that I need to know about?

Most mortgage lenders expect mainly 3 trade lines on your credit report like auto loans, credit cards, personal loans, or other qualifying lines of credit. There may be exceptions like alternative bills that are often allowed (phone bills, utilities, etc.).

Is down payment assistance available to someone with a 638 credit score?

Yes, at present the programs exist at the local (city, county, or state level), and nationwide level. A mortgage lender can help you to check if you qualify for down payment assistance. For lower-income, the chances are more likely to qualify, as these programs are often intended for lower-income households.

What are the interest rates for a borrower with a 638 credit score?

The interest rate will depend on your individual qualifications, the mortgage lender, and the date you lock your interest rate.

0 Comments